Financial Efficiency and VAT compliance for small business owners with Zoho Finance Plus

Posted on: Mon Aug 26, 2024

Small business owners in the UAE have been going through a steep learning curve to comply with the VAT regulations introduced in 2018. Adjusting and conforming to the new tax rules has been confusing. In particular, those used to dealing with the old way of looking into finances were in trouble because of the latest considerations and preparations added with VAT requirements. Besides, the sudden demand to track transactions that involve VAT and follow current and detailed regulations added to the trouble. Let’s see the role of ZOHO finance plus!

Picture this: You run a small business and must figure out these complex VAT requirements. It’s easy to be overwhelmed by the many new rules and all the extra work that is required to remain compliant. Most of your time and possible errors from such manual financial procedures, such as inputting data by hand and tracing every detail of VAT, take you away from focusing on growing the business.

What is an easy, practical, and effective solution?

Zoho Finance Plus, an integrated suite of financial tools meant for businesses, can also simplify VAT compliance and streamline the user’s overall financial management. It brings all the financial tasks together under one easy-to-use platform so that you can turn your focus away from the apprehension caused by VAT and manual tasks.

1. In-depth Understanding of Zoho Finance Plus

a. Making VAT Compliance Easy

VAT management is streamlined automatically, without any hassle, and comfortably integrated with your overall financial operations. This leads to hassle-free operations with the help of automatic VAT calculation and appropriate reporting.

b. Unified Platform

The integrated capability of six top-rated financial applications ensures frictionless communication and real-time updates accessible from a single console.

c. Centralized Console

One centralized console to access all the applications for optimized views of your financial operations.

d. Automatic Update

App updates reflect across automatically, with no syncing required.

e. Built from the same Database

Zoho Finance Plus applications share the same database; hence, there is no syncing delay after data updates.

f. User-Friendly Interface

Its easy-to-navigate and intuitive design makes it user-friendly for business owners and finance pros alike.

g. Easily Customizable

The suite is easy to use and offers powerful customization and reporting tools for accountants and admins.

2. Fundamental Building Blocks of Zoho Finance Plus

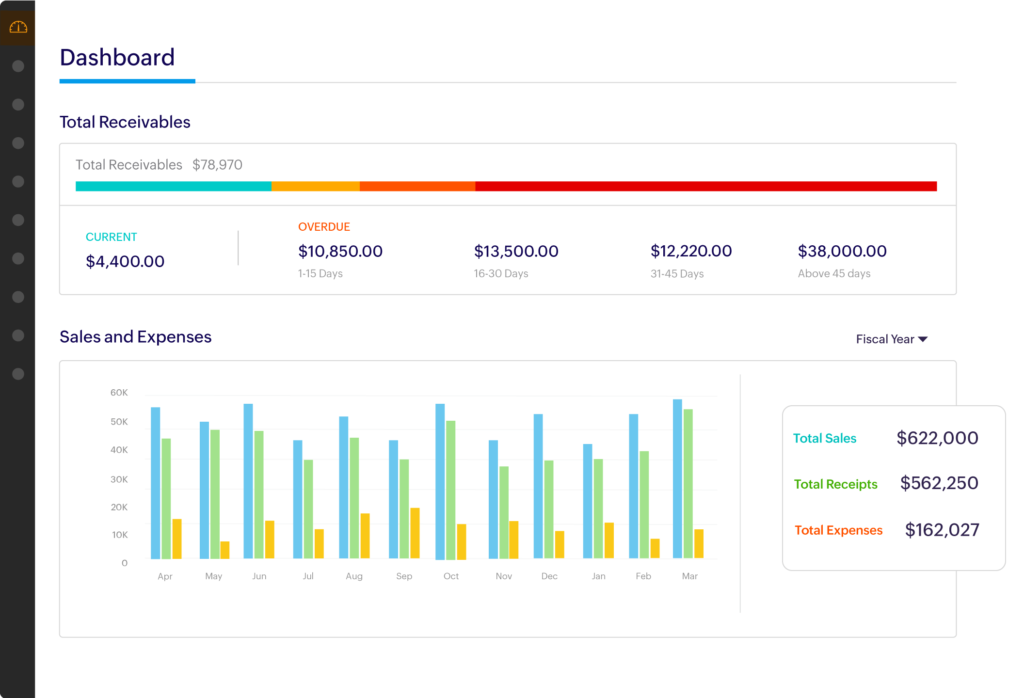

a. Zoho Invoice

Source – Zoho

- Automatic invoice generation

- Automatically receive payment online

- Add a new customer

- Adding item details

- Supports time-based billing processes

- Mobile-friendly interface

- Time tracking capabilities

- Customizable templates

- Insightful reporting

- Automation features

- Smart dashboard design with prominent alerts for immediate action (payment overdue)

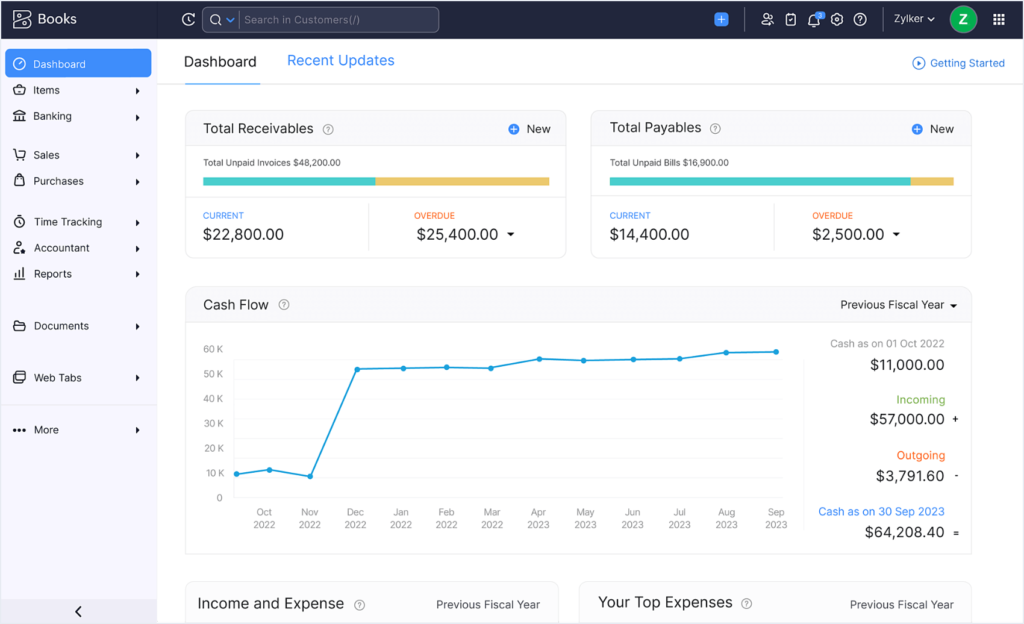

b. Zoho Books

Source – Zoho

- The core of all Zoho Finance applications

- Ensures VAT compliance easily

- Increasingly adopted for accuracy and ease of use

- Connects accounting system to banking system

- Automatic import and updates from bank transactions

- Partners with major banks in UAE

- Supports 11 payment gateways for online payments

- Double-entry accounting system

- Client access when needed

- Automates payables and receivables

- Recurring invoices management

- Expense management

- Cheque printing and vendor payments

- Inventory management

- Comprehensive financial reporting

- Smart dashboards for quick action on key parameters

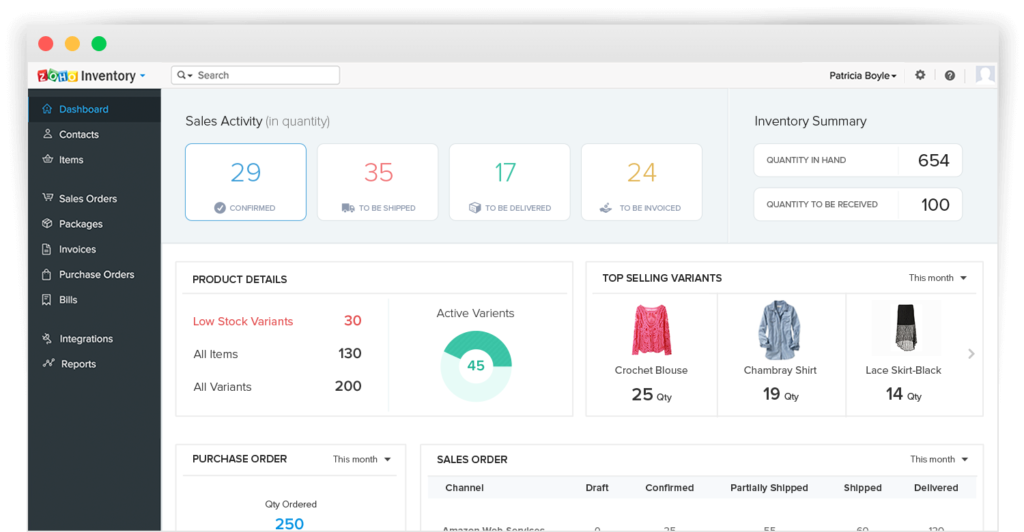

c. Zoho Inventory

Source – Software advice

- Connect to marketplaces like Amazon, Etsy, and eBay

- Auto-create sales orders

- Integrate with e-commerce shopping carts

- Create and manage items

- Shipping integrations

- Comprehensive workflow management

- Multichannel selling

- Actionable insights

- Seamless integration with other Zoho apps

- Instant updates

- Manage multiple warehouses

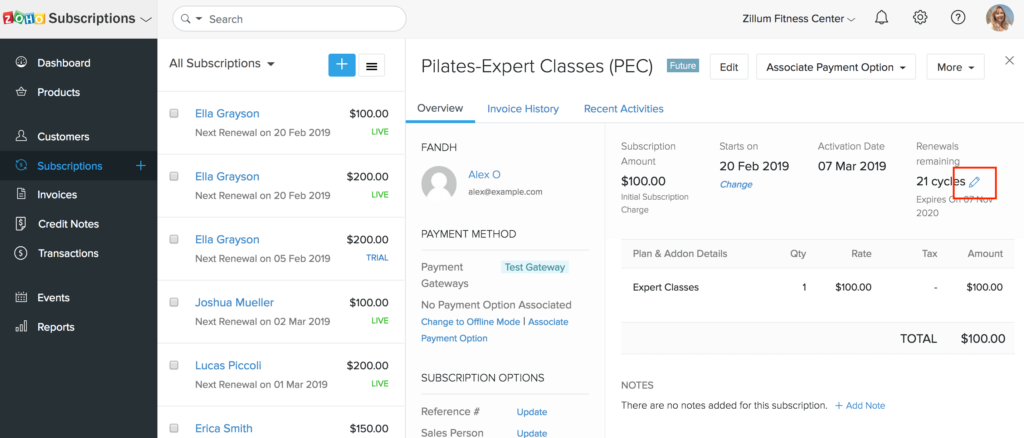

d. Zoho Subscriptions

Source – Zoho

- Subscription automation

- Efficient and automatic dunning processes (overdue, failed payments)

- Payment card industry-compliant payment pages

- Client portals for subscription cancellation and manual renewal payments

- Self-sign-up pages for integration into websites

- Subscription analytics

- Seamless integration with Zoho Books

- Ability to add new subscription plans

- Customization options

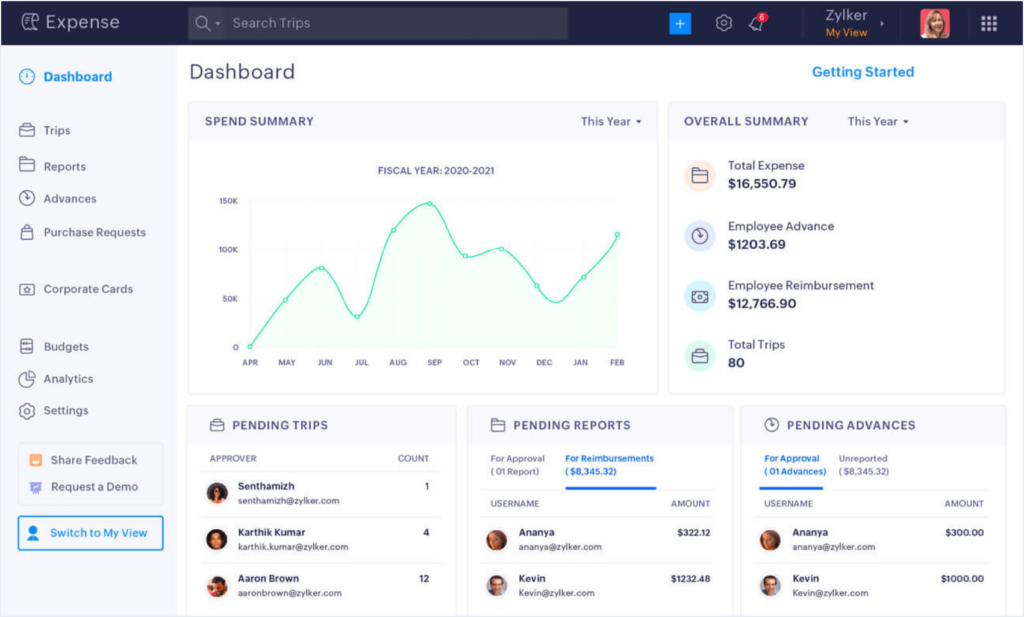

e. Zoho Expense

Source – Zoho

- Mileage tracking

- Track hotel bills with automatic scanning

- No manual data upload is required

- Create standard or profile-specific expense policies

- Dynamic approval processes

- Automation of expense reporting

- Seamless integration with Zoho Books

- Turn transactions into expenses

f. Zoho Checkout

- Create custom online payment pages

- Integrate payment pages into your website and social media

- Allow users to access and make direct payments

- Automatic invoice generation for payments through Zoho Books

g. Zoho Payrolls

- Automatic Payroll Calculation

- Compliance Made Easy

- Custom features

- Intuitive user interface

- Adapt to various salary structures

Zoho Finance Plus delivers a unified financial experience—simplicity, strength, and functionality- effectively and freely administering VAT and other financial processes.

3. How Does Zoho Finance Plus Solve These Challenges?

a. Seamless VAT Compliance

One of the hardest things for most companies is ensuring VAT compliance, especially in regions that place a tight leash on their taxation policies, such as the UAE. One of the modules in Zoho Finance Plus is Zoho Books, which makes the automation of VAT calculations, returns preparation, and filing easier. There is a guarantee that all transactions are captured under the correct VAT rates in the bid to avoid errors. The software accommodates the creation of VAT-compliant invoices while preparing tax returns that comply with the local tax authority’s requirements. For example, a small business operator would comfortably retire to bed assured that Zoho Books would remind him of the deadlines for VAT filing and report auto-generation for compliance without the hassle and the related penalties.

How Zoho Helps Small Business Owners with VAT Regulations?

Compliance with the new Federal Tax Authority demands much work. With its all-in-one solution, Zoho Books helps small business owners in Dubai stay VAT-compliant easily. Here’s how Zoho Books might make VAT management a cakewalk for your business.

- Make VAT-ready Documents

- Make FTA-approved tax and self-billing invoices and create credit/debit notes.

- Personalize templates to cover all data fields required by law.

- Capture the details of the transactions correctly. For every transaction, you need to input the details of the VAT rates and places of supply.

- Categorize customers and vendors as VAT-registered, non-VAT-registered, and non-GCC entities for accurate tax recording.

- Special VAT rates for excise goods and digital services.

- Easily prepare correct tax return records.

- With the aid of Zoho Books Plc, you can easily reconcile transactions and file your tax return records.

- Generate VAT Return Summary with all relevant information for filing returns in the FTA portal.

- Generate Insightful Reports

- View Balance Sheets, Profit and Loss Statements, and Cash Flow Statements.

- Generate VAT Audit Files (FAF) for easy audits and compliance.

- Store Secure Financial Data

- VAT Configuration is Effortless

b. Integrated Financial Operations

Running multiple financial tasks on various platforms is usually the source of data discrepancies and inefficiencies. Zoho Finance Plus resolves this by having an all-in-one platform for the different financial processes. Run businesses more efficiently with applications like Zoho Books, Zoho Inventory, and Zoho Subscriptions, which will all work together to maintain real-time data accuracy. This applies to operations ranging from inventory management of an e-commerce company to tracking expenses and financial reports in one place. This integration eliminates manual data entry into multiple systems, decreasing errors and saving time. This indirectly allows business owners to devote their precious time toward growing the business instead of spending it on trivial matters.

c. Automated Invoice and Payment Reminder

Cash flow is the key factor to any business. Zoho Invoice automates the entire invoicing process, from generation to sending it out to the clients. It offers automated reminders for payment, thus serving as a watchdog for clients regarding due payments, with no manual follow-up required. For example, a digital marketing company using Zoho Invoice can create automatic reminders for invoices past due, saving hours in hunting down payments to boost cash flow. With this automation, a consistent cash flow will be set in place, empowering any business to have a robust and healthy financial operation.

4. Pricing and accessibility

Affordable Pricing: By providing a pocket-friendly solution to small business owners in Dubai and UAE, Zoho Finance Plus offers great value for money. Access to 10 users per month is provided in the affordable packages—which enable you to keep the records efficiently for your business.

Fits All Business Sizes: Whether you’re a start-up or a large enterprise, Zoho Finance Plus can scale to meet your requirements. It’s designed to grow as your business grows.

With Zoho Finance Plus, you get a very powerful financial tool at quite an affordable price. It is versatile—perfect for any business— a valuable tool for businesses of all sizes.

5. How can I get Zoho Finance Plus, Installation, and Support?

Are you ready to integrate and automate your financials with Zoho Finance Plus? You need not worry about the setup and installation all by yourself. Partnering with a reliable provider like SPK Auditors and Accountants will make your journey with Zoho Finance Plus smooth and successful. SPK is the leading Professional Auditors, Tax Experts,& Business Advisory firm in Dubai, UAE. They are also the recognized resellers of Zoho Finance Plus within the UAE. With a solid 25-plus-year background, they are very aware of the financial issues businesses face. They have the necessary capability and resources to deliver solutions that work for you.

a. Know more about SPK Auditors and Accountants

Experience and Expertise: Decades of experience in the financial industries empower SPK with unmatched accounting and finance prowess.

Professional Team: Their team of professionals is dedicated to delivering top-of-the-line service and support at all stages of your journey with Zoho Finance Plus.

Efficient Delivery: SPK ensures a smooth installation process in the shortest possible time so your business can keep running with minimum disruptions.

Tailored Advice and instant support: More than installation, SPK will give personalized advice and instant support on the best way to realize value from Zoho Finance Plus by tailoring it to your business goals.

Ready to witness a change in how you manage your finances with Zoho Finance Plus?

Contact SPK Auditors and Accountants today for a consultation!